A Complete Guide to Read Mention Network Brand Report

Mention Network delivers something the industry desperately needed: empirical data on how brands actually perform across major AI platforms. We provide a comprehensive brand report powered by 284,699 AI-generated answers, 23,725 real-user prompts, and 1,303,946 citations across 6 LLMs (updated October 9, 2025).

The report analyzes how your brand performs when real users ask AI assistants for recommendations, comparisons, and guidance. This guide will walk you through each section of the report and show you how to extract actionable insights from the data.

- The report measures your visibility across six major AI platforms: Grok, ChatGPT, Deepseek, Perplexity, Google, and Gemini

- Rankings compare your performance against thousands of competitors based on real AI responses, not simulated queries

- Topic analysis reveals which categories you dominate and where competitors outperform you

- Citation metrics show whether AI models trust your content as an authoritative source

- Geographic data maps your brand strength across 132 countries and identifies expansion opportunities

Overview Section

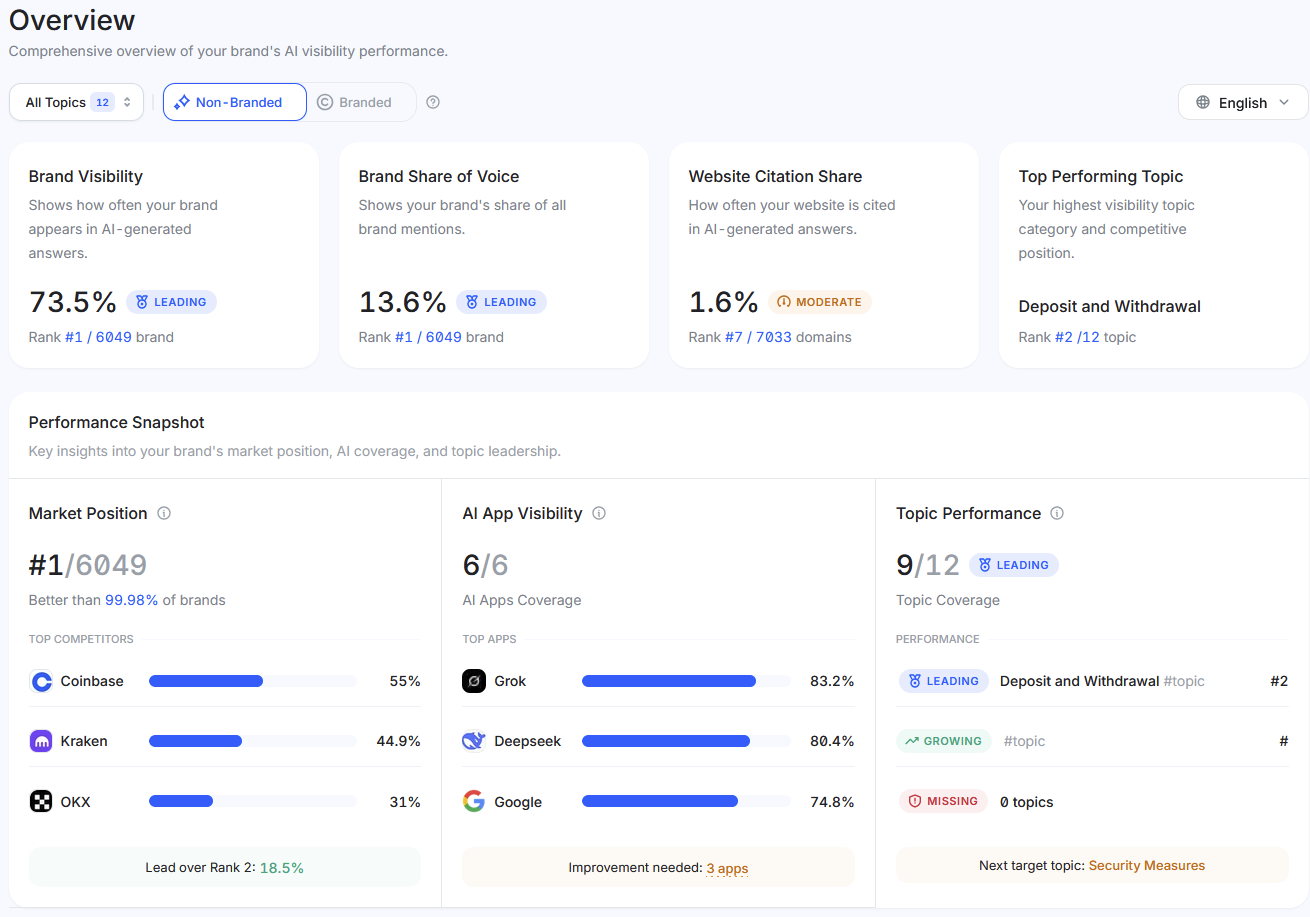

The Overview dashboard is your starting point, providing four critical metrics at a glance. Think of this as your executive summary before diving into the detailed analysis.

1, Brand Visibility shows how often your brand appears in AI-generated responses across all tracked topics.

This percentage represents your "share of appearances" in the AI recommendation space. For example, if you see 73.7% with a "LEADING" badge and rank #1 out of 6,234 brands, it means you appear in roughly three out of every four AI conversations about your industry. The ranking compares you against every tracked competitor in your space.

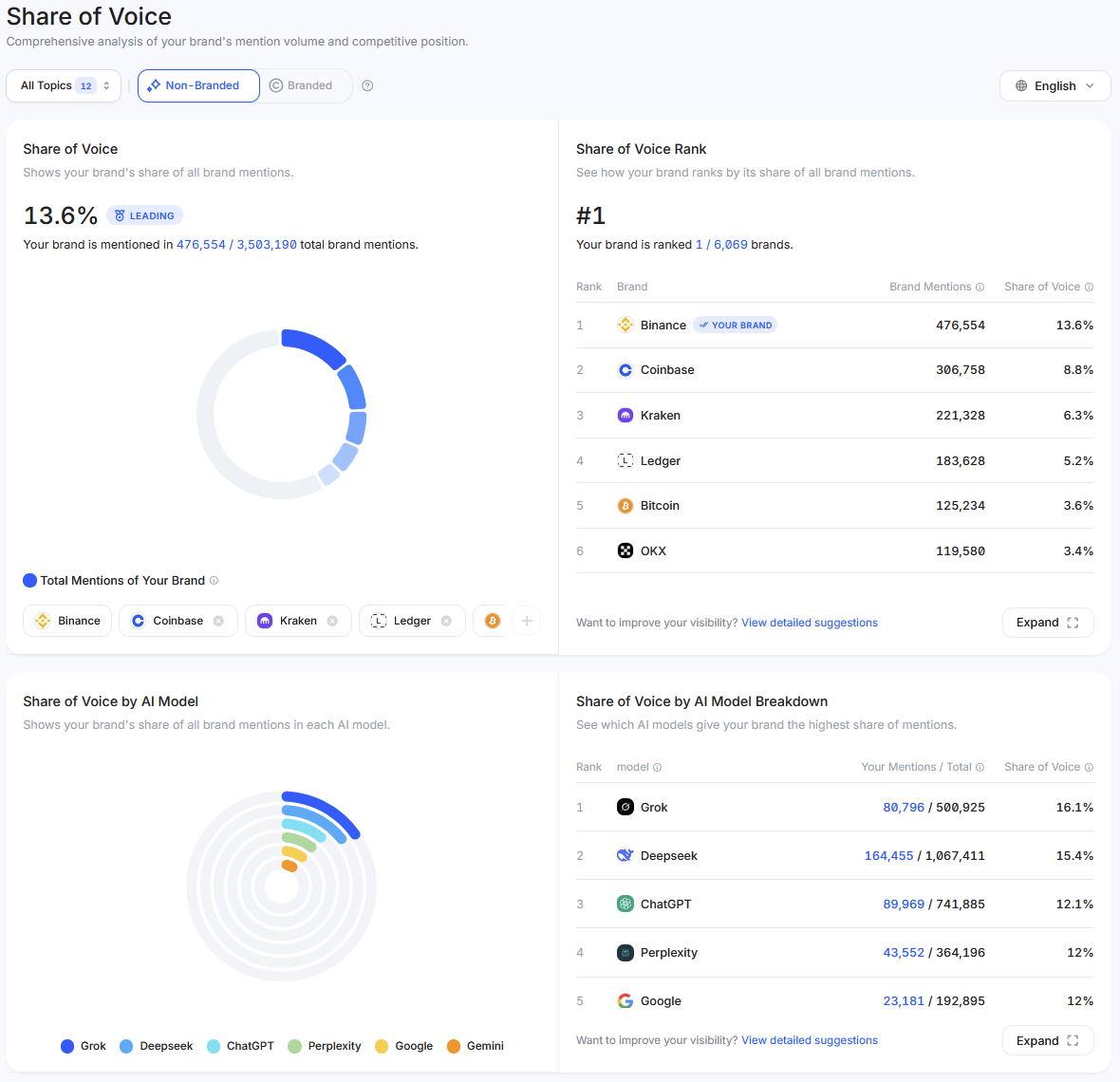

2, Brand Share of Voice measures your portion of total brand mentions across all AI conversations. While visibility tells you how often you appear, share of voice tells you how much of the overall conversation you capture.

A 13.6% share means Binance accounts for roughly one-seventh of all brand mentions in their industry's AI discussions. The rank shows your position in terms of mention volume, not just frequency of appearance.

3, Website Citation Share reveals how often AI models reference your website as a source when answering questions.

This metric (like 1.6% with rank #7 out of 7,033 domains) indicates whether AI systems view your content as authoritative enough to cite. Low citation share even with high visibility suggests AI models know about Binance but don't trust them content as a primary source.

4, Top Performing Topic identifies which category generates your highest visibility. This shows you where you've built the strongest presence in AI recommendations.

In the example, "Deposit and Withdrawal" at rank #2 out of 12 topics tells you this category is your competitive strength, though there's room to reach the top position.

The Performance Snapshot breaks down three key dimensions you'll explore in detail later. Market Position (#1/6234 better than 99.98% of brands) contextualizes your overall competitive standing. AI App Visibility (6/6 AI Apps Coverage) shows how many of the six tracked AI platforms mention your brand, with specific performance on each. Topic Performance (9/12 LEADING) summarizes how many topic categories you dominate versus competitors.

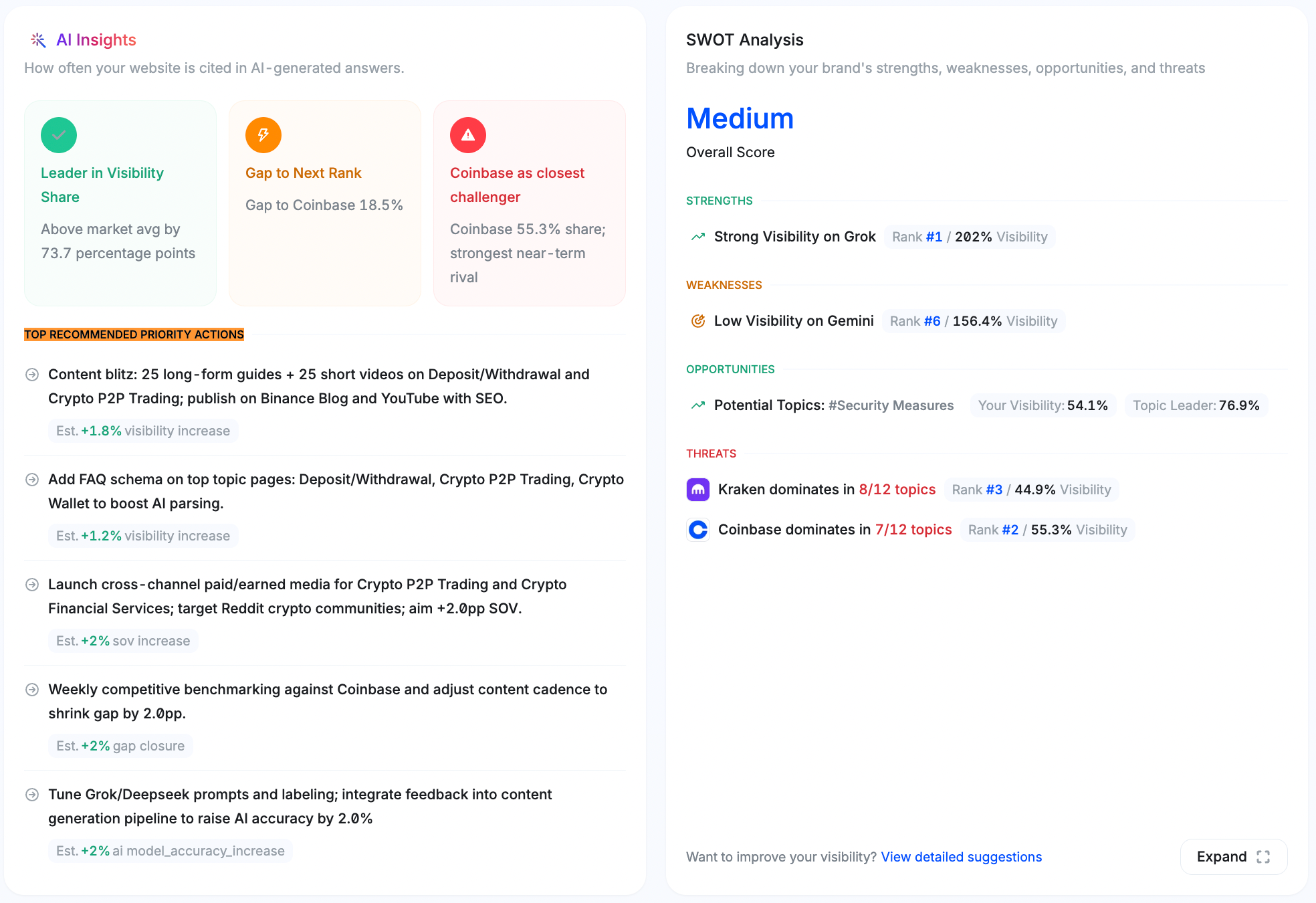

Using the AI Insights and SWOT Analysis

The AI Insights section synthesizes data from across the report into a SWOT (Strengths, Weaknesses, Opportunities, Threats) framework with actionable recommendations.

How to read the SWOT quadrants:

1, Strengths highlight what you're doing well. Look for indicators like:

- "Market leadership in visibility" with specific rank and percentage

- "Strong Visibility on [AI Platform]" with rank and metrics

- These tell you what competitive advantages you've built

For example: "Market leadership in visibility - Rank 1 of 6234 with 73.7% visibility" confirms you're the top performer. "Strong Visibility on Grok - Rank #1 / 202% Visibility" tells you which specific platforms favor your brand most.

2, Weaknesses identify performance gaps. Common patterns include:

- "Low Visibility on [AI Platform]" with lower rank numbers

- "Gap to #2 [Competitor]" with percentage differentials

- These show where you're vulnerable to competitive pressure

For example: "Low Visibility on Perplexity - Rank #6 / 156.3% Visibility" means you're underperforming on this specific platform compared to your overall #1 position.

3, Opportunities suggest areas for strategic investment. Look for:

- "Potential Topics" with visibility percentages and topic leader comparisons

- These identify categories where focused effort could yield significant gains

For example: "Potential Topics: #Security Measures - Your Visibility: 54.1%, Topic Leader: 76.9%" shows a category where you could improve by 22.8 percentage points with targeted content.

4, Threats warn about competitive pressures. Watch for:

- "[Competitor] dominates in X/Y topics" with specific ranks and visibility

- These identify rivals gaining ground in multiple categories

For example: "Kraken dominates in 8/12 topics - Rank #3 / 44.9% Visibility" indicates a competitor with broad-based strength across many categories.

Top Recommended Priority Actions

It translates insights into specific tasks. Each recommendation includes:

- Action: What to do (e.g., "Launch Coinbase comparison campaign on Binance blog and YouTube")

- Target: Where to focus (e.g., "weekly SOV tracking")

- Expected Impact: Estimated improvement (e.g., "Est. +4.9% sov gap_reduction")

Prioritize actions with the highest estimated impact that align with your strategic goals. These recommendations are derived from analyzing your performance gaps and competitive positioning across all metrics.

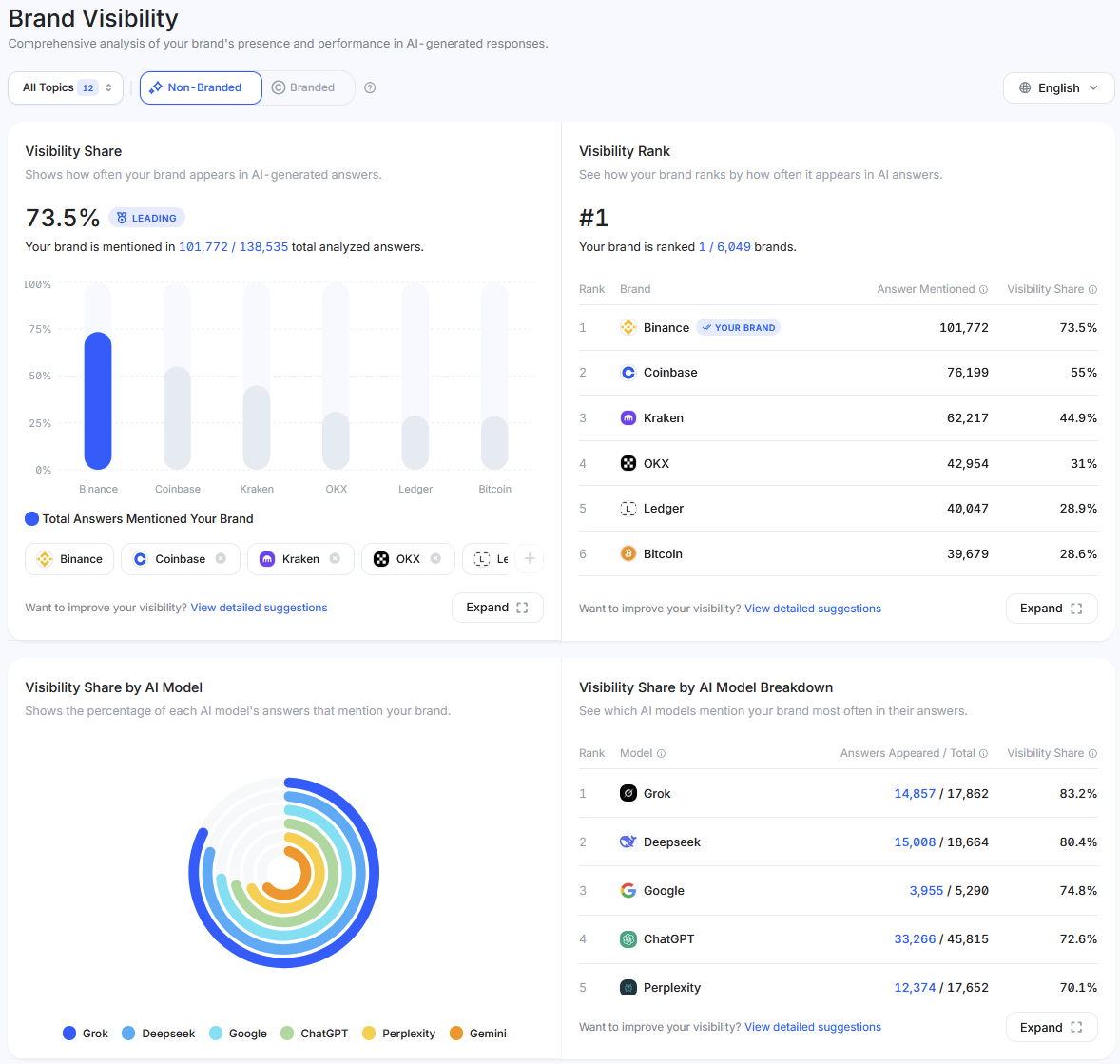

Reading Your Brand Visibility Metrics

The Brand Visibility section provides detailed analysis of how often and where your brand appears in AI-generated responses. This page contains three main components you need to understand.

1, Visibility Share displays your overall appearance rate with the total number of answers mentioning your brand.

For instance, "73.7% LEADING, your brand is mentioned in 103,792 / 140,741 total analyzed answers" tells you that out of roughly 141,000 AI responses about your industry, Binance appeared in about 104,000 of them. The bar chart visualizes your performance against top competitors, making it easy to see the gap between Binance and others at a glance.

2, Visibility Rank shows your competitive position in a ranked table.

Look for the "YOUR BRAND" tag to find yourself, then examine the Answer Mentioned and Visibility Share columns. If you see competitors above you, note their numbers - this is the performance bar you need to exceed.

For example, seeing Binance brand at #1 with 103,792 mentions (73.7%) compared to #2 with 77,818 mentions (55.3%) quantifies their competitive advantage.

3, Visibility Share by AI Model breaks down which platforms mention you most frequently.

The circular visualization and accompanying table show performance across Grok, Deepseek, ChatGPT, Google, Gemini, and Perplexity.

Pay attention to percentages over 100% - this means the AI mentions them multiple times per response on average. For example, "Grok: 36,395 / 18,018 = 202%" indicates Grok mentioned the brand roughly twice per relevant conversation. This level of detail helps you understand which AI platforms favor your brand and which ones need improvement.

Understanding Share of Voice Data

Share of Voice measures your brand's portion of total mentions across all tracked conversations. While visibility tells you how often you appear, share of voice reveals how much of the total conversation belongs to you.

1, The main metric shows your percentage and mention volume.

For example, "12.9% LEADING - Your brand is mentioned in 1,065,116 / 8,270,454 total brand mentions" means that out of over 8 million brand mentions across all AI conversations, Binance captured about 1 million of them. The circular chart visualizes your share compared to the rest of the market.

2, Share of Voice Rank presents a competitive leaderboard.

Find your brand (marked with "YOUR BRAND" tag) and compare your Brand Mentions and Share of Voice percentages with competitors. If you're ranked #1 with 1,065,116 mentions (12.9%) while #2 has 703,584 mentions (8.5%), you're capturing roughly 50% more conversation volume than your nearest competitor.

3, Share of Voice by AI Model shows platform-specific breakdown.

The table displays "Your Mentions / Total" for each AI platform. For instance, "Grok: 186,961 / 1,230,389 = 15.2%" tells you that on Grok specifically, your brand captured 15.2% of all brand mentions. Compare these percentages across platforms to identify where you're strongest and where competitors dominate.

The key insight here is understanding the relationship between visibility and share of voice. You might have 70% visibility (appearing in most responses) but only 10% share of voice (brief mentions). Conversely, 50% visibility with 20% share of voice means when you appear, you're discussed extensively. Strong performance requires both metrics working together.

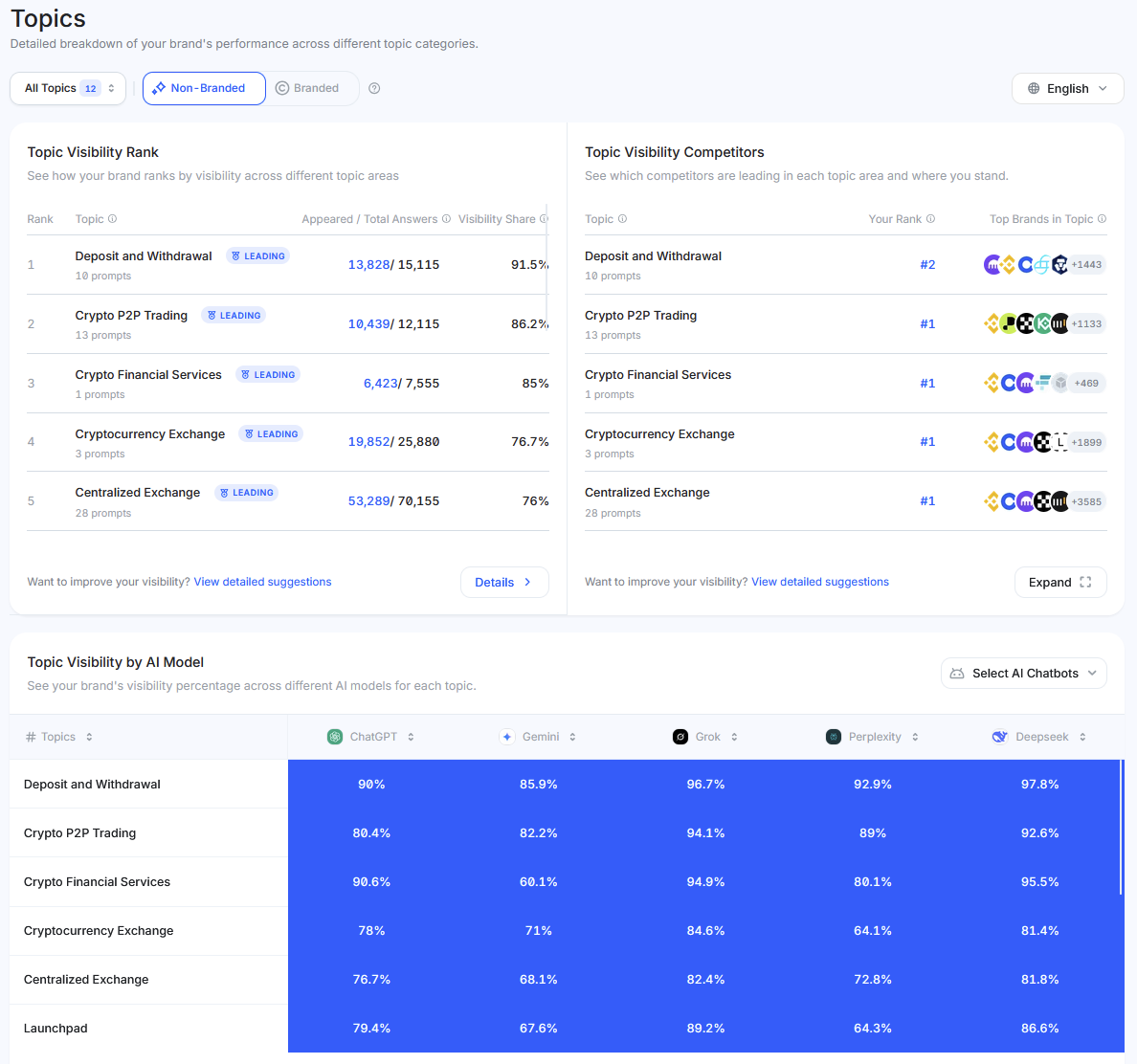

Navigating Topic Performance Analysis

The Topics section breaks down your visibility across specific categories, revealing where you excel and where competitors outperform you. This is where strategy gets tactical.

1, Topic Visibility Rank lists all tracked topic categories with your performance in each. The table shows several key columns:

- Topic name and prompt count: "Deposit and Withdrawal - 10 prompts" tells you the category and how many different user questions fall into it

- Status badge: "LEADING" means you rank in the top positions for that topic

- Appeared / Total Answers: "13,810 / 15,096" shows your brand appeared in 13,810 out of 15,096 AI responses for this topic

- Visibility Share: "91.5%" indicates your appearance rate in this specific category

Scan this table to identify your strongest categories (highest visibility %) and weakest ones (lower rankings or percentages). Topics marked "LEADING" are your competitive advantages.

2, Topic Visibility Competitors shows which brands compete with you in each category. Next to each topic, you'll see icons of top-performing brands with a prompt count. For example, "Deposit and Withdrawal: 10 prompts" followed by competitor icons and "+1439" tells you there are 1,439 total brands in this category and shows the leading brands. If you don't see your icon among the leaders, you're being outperformed in that topic.

3, Topic Visibility by AI Model presents a heat map table showing your visibility percentage for each topic on each AI platform. For instance, you might see:

- Deposit and Withdrawal: ChatGPT 89.8%, Gemini 86.2%, Grok 96.8%, Perplexity 93.1%, Deepseek 97.8%

- Crypto P2P Trading: ChatGPT 80.6%, Gemini 82.7%, Grok 94.2%, Perplexity 89.3%, Deepseek 92.7%

The darker blue indicates higher performance. This granular view helps you understand which AI platforms favor you in specific topics. If one platform consistently shows lower percentages, that platform may use different ranking criteria or trust different content sources.

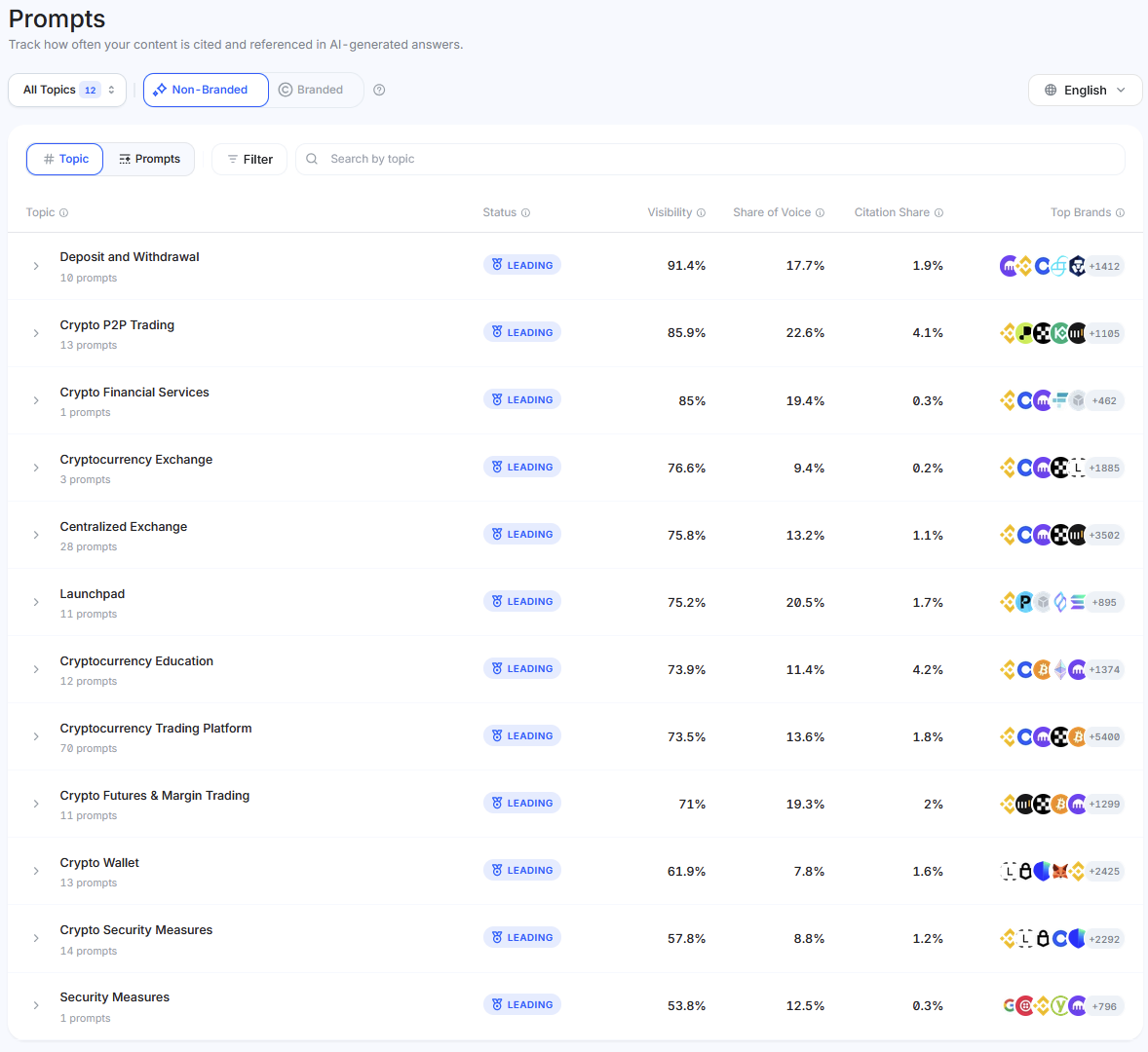

Reading Prompt-Level Performance Data

The Prompts section is where you see the actual questions users ask that mention your brand. This data connects your visibility metrics to real user intent. The section has two views: by Topic and by Prompt.

1, Topic View groups all prompts into categories. You'll see:

- Topic name with total prompt count

- Status badge (LEADING, STRONG, WEAK)

- Visibility, Share of Voice, and Citation Share percentages

- Icons showing top-performing brands in that topic

For example, "Deposit and Withdrawal - 10 prompts, LEADING, 91.5% visibility, 17.7% share of voice, 1.9% citation share" tells you there are 10 different questions in this category, Binance are leading in it, them appear in 91.5% of responses, and capture 17.7% of mention volume.

2, Prompt View shows individual questions with detailed metrics. Each row displays:

- The actual question: "Which crypto wallets offer the best integration with trading platforms?"

- Mention Status: "Mentioned (5,991/6,342)" means your brand appeared in 5,991 AI responses out of 6,342 total answers to this question

- Topic tags: Shows which categories this prompt relates to (e.g., #Cryptocurrency Trading Platform, #Crypto Wallet)

- AI platform icons with mention count: Small icons showing which AI platforms answered this question

- Visibility %: Your appearance rate for this specific question

- Share of Voice %: Your mention volume for this question

Focus on high-volume prompts where your brand is "Mentioned" - these are questions driving your visibility. Also identify high-volume prompts where you're NOT mentioned - these represent content gaps and missed opportunities.

The "Mentions" column with AI platform icons helps you understand which platforms users query most frequently for specific topics. If you see ChatGPT and Perplexity icons with high counts, those platforms receive the most questions in that area.

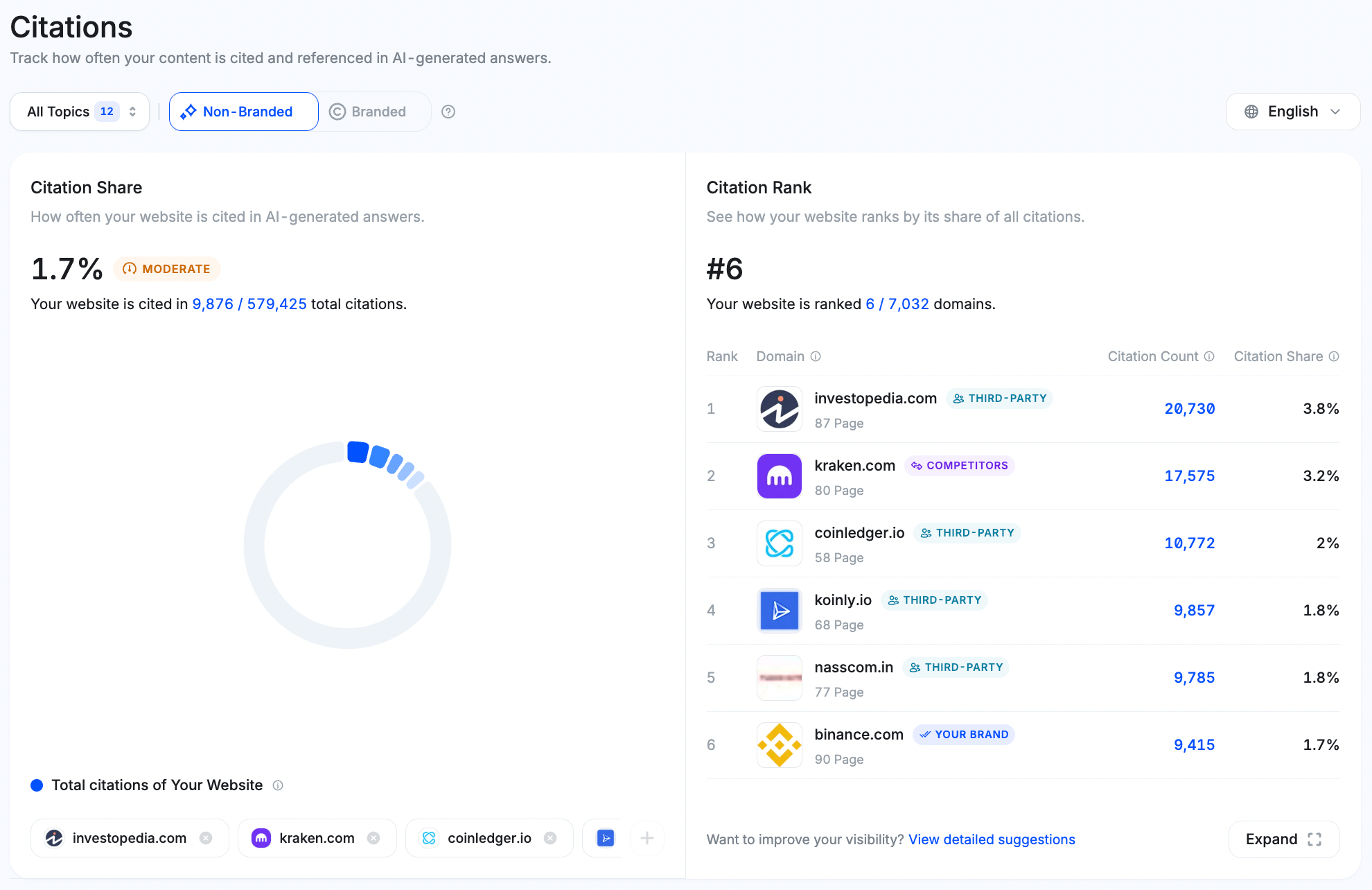

Interpreting Citation Metrics

Citations measure how often AI models reference your website as a source when generating answers. This is distinct from brand mentions - citations mean the AI trusted your content enough to cite it as an authoritative source.

1, Citation Share shows your percentage of total citations. For example, "1.7% MODERATE - Your website is cited in 9,876 / 579,425 total citations" means AI models cited your website as a source roughly 10,000 times out of 579,000 total citations. The "MODERATE" status indicates you're being cited but not at industry-leading levels.

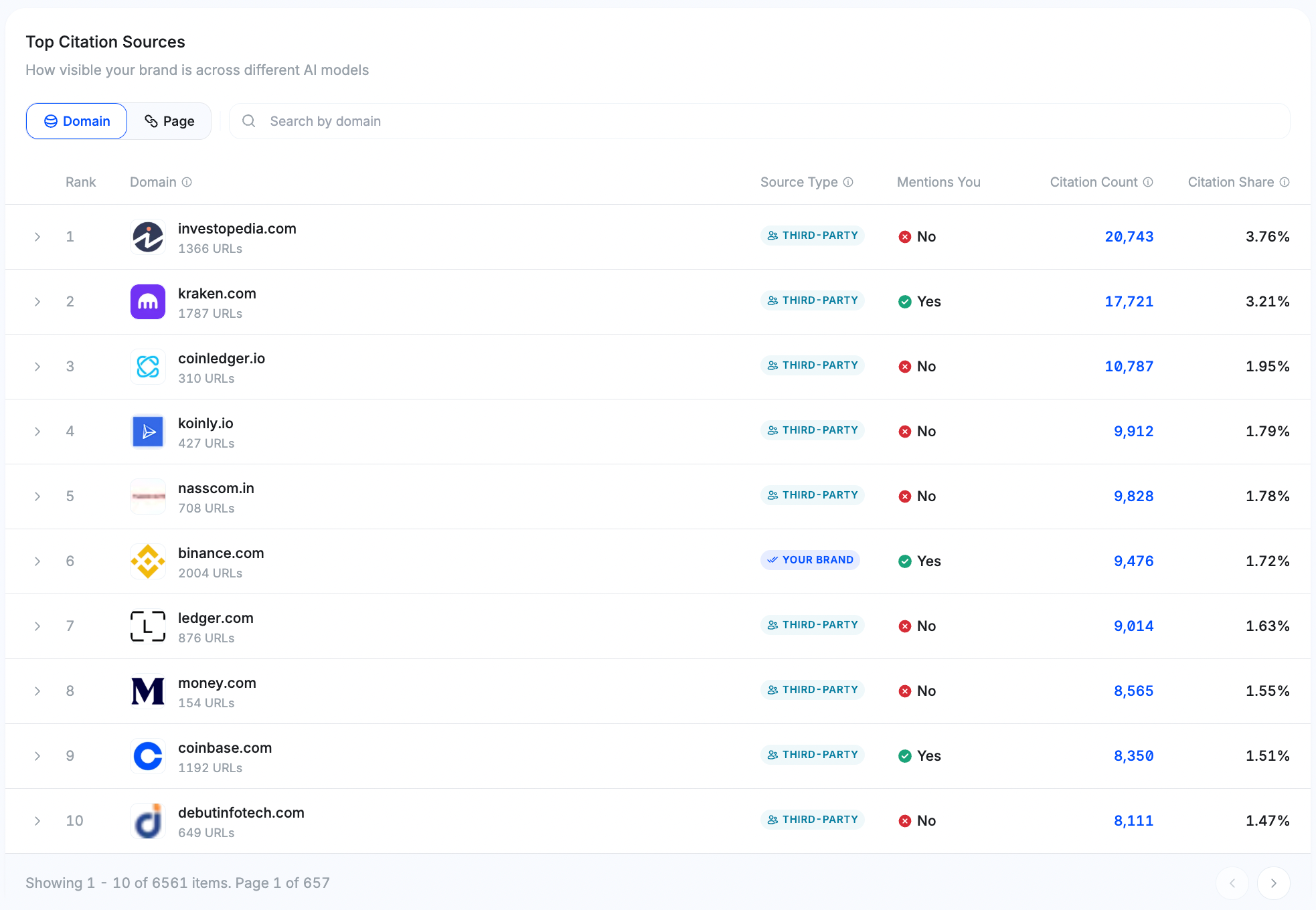

2, Citation Rank displays where you stand against all competing domains. The table shows:

- Domain name with identifying tags ("YOUR BRAND" or "COMPETITORS" or "THIRD-PARTY")

- Page count: How many pages from that domain were cited

- Citation Count: Total number of times cited

- Citation Share: Percentage of total citations

For instance, seeing "investopedia.com - THIRD-PARTY –20,730 - 3.8%" above your brand tells you a third-party publisher captures more citations than you do. This is normal and often indicates that AI models trust educational content from established publishers.

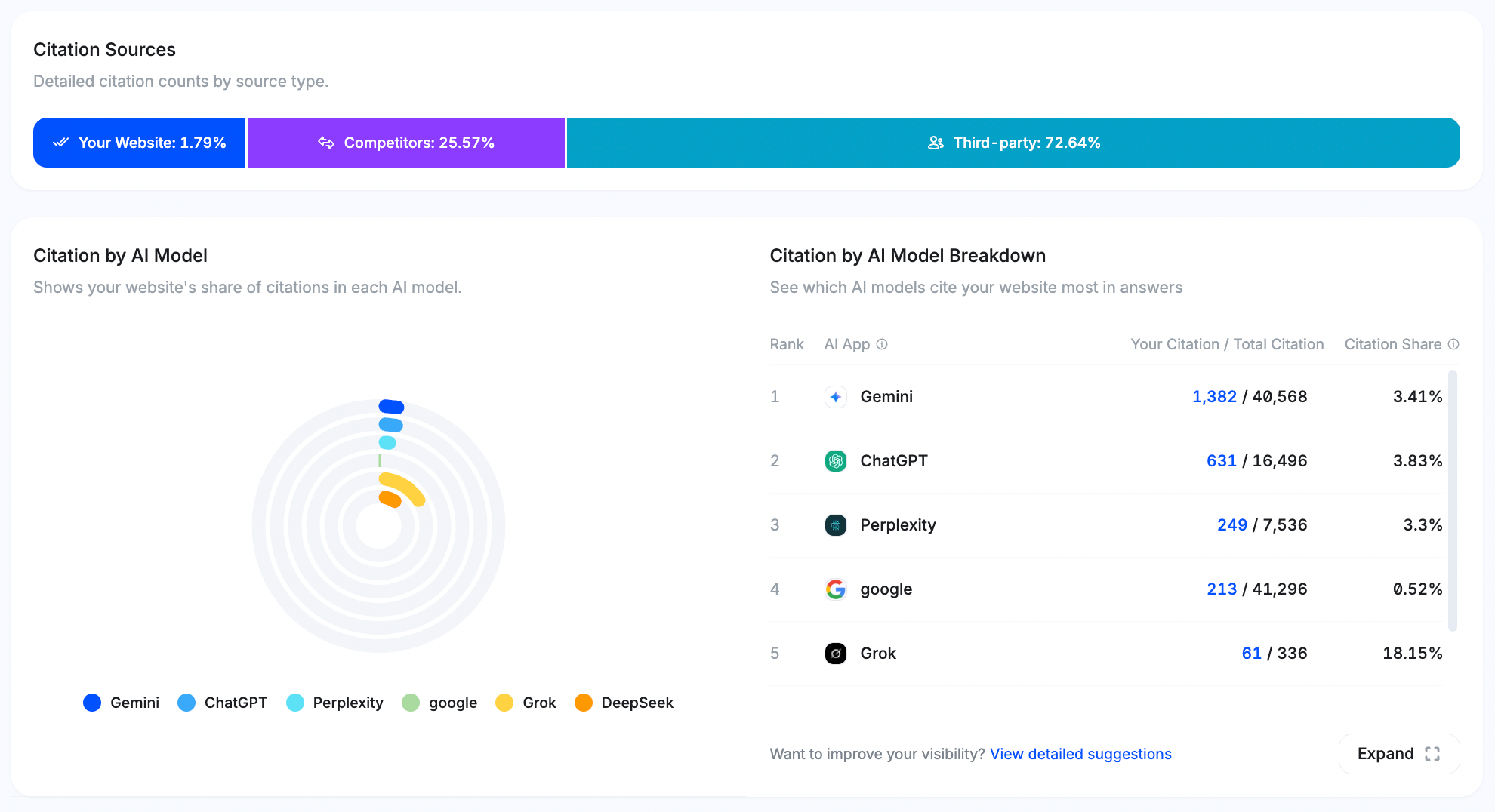

3, Citation Sources breaks down where citations come from in three categories:

- Your Website: Direct citations from your own domain

- Competitors: Citations from competitor websites

- Third-party: Citations from news sites, educational platforms, aggregators

The horizontal bar chart shows the distribution. If you see "Your Website: 1.79%, Competitors: 25.57%, Third-party: 72.84%", it means most citations come from third-party sources, which is typical but also shows opportunity to strengthen your own content authority.

4, Citation by AI Model reveals which platforms cite you most. The circular chart and table show breakdowns like:

- Gemini: 1,382 / 40,568 = 3.41%

- ChatGPT: 631 / 16,496 = 3.83%

- Perplexity: 249 / 7,536 = 3.3%

These percentages tell you which AI platforms view your content as citation-worthy. Lower percentages on specific platforms indicate those systems prefer different content types or sources.

5, Top Citation Sources table highlights which domains AI models most frequently reference when citing information relevant to your brand.

Each entry lists the domain, citation type, whether it explicitly mentions your brand, and its share of total citations giving a clear picture of the content ecosystems that shape AI trust.

Example: Investopedia.com leads with 20,743 citations (3.76%), Kraken.com holds 17,721 citations (3.21%) notable as both a third-party and an active brand mention source. Binance domain appears in 6th place, marked as “YOUR BRAND”, with 9,476 citations (1.72%).

This ranking positions your brand within the same reference tier as your industry, signaling solid visibility and trust within AI knowledge graphs. Increasing long-form, data-backed, and educational content could elevate your citation share further toward top-tier benchmarks.

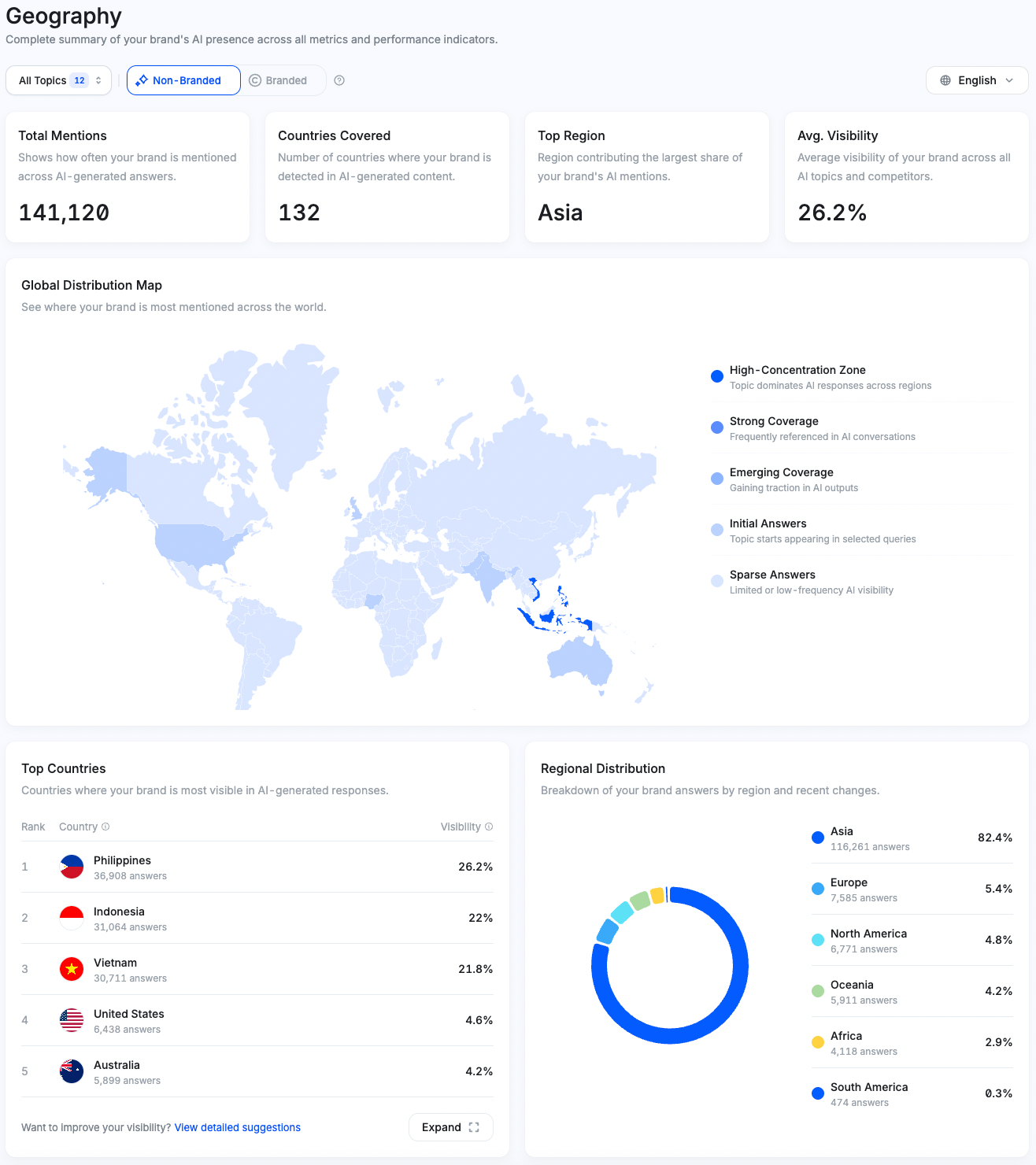

Analyzing Geographic Distribution Data

The Geography section shows where in the world your brand gets mentioned in AI responses. This helps identify regional strengths and expansion opportunities across 132 tracked countries.

1, The overview metrics provide global context:

- Total Mentions: How many times your brand appeared across all countries (e.g., 140,809)

- Countries Covered: Number of countries where your brand appears in AI responses (e.g., 132)

- Top Region: Your strongest geographic area by mention share (e.g., Asia)

- Avg. Visibility: Your average visibility percentage across all topics and regions (e.g., 26.2%)

2, Global Distribution Map visualizes your geographic strength using color intensity. Darker blue regions indicate higher mention concentration. The legend shows five tiers:

- High-Concentration Zone: Your brand dominates AI responses in these regions

- Strong Coverage: Frequently referenced in AI conversations

- Emerging Coverage: Growing presence but not yet dominant

- Initial Answers: Brand appears occasionally

- Sparse Answers: Limited or low-frequency visibility

Use this map to quickly identify where you're strongest and where you have room to grow.

3, Top Countries ranks individual countries by visibility percentage and answer count. For example:

- Philippines: 26.2% visibility, 38,895 answers

- Indonesia: 22% visibility, 31,027 answers

- Vietnam: 21.6% visibility, 30,458 answers

- United States: 4.6% visibility, 6,438 answers

- Australia: 4.2% visibility, 5,899 answers

The visibility percentage shows how often you appear in AI responses within that specific country. The answer count indicates total question volume. High visibility with low answer count might mean strong regional performance but limited market size or query volume.

4, Regional Distribution summarizes performance by continent using a circular chart and table:

- Asia: 82.3%, 115,955 answers

- Europe: 5.4%, 7,583 answers

- North America: 4.8%, 6,771 answers

- Oceania: 4.2%, 5,911 answers

- Africa: 2.9%, 4,113 answers

- South America: 0.3%, 474 answers

This shows where your brand has built the strongest AI presence. Dramatic disparities (like 82% in Asia vs 5% in Europe) reveal either intentional market focus or untapped expansion opportunities.

Putting Your Report Into Action

The Mention Network Brand Report is more than just a set of charts. It helps you see not only how your brand performs across AI platforms but also where to focus your efforts to get the best results. Think of it as a practical guide that connects data to real actions.

Start by reviewing the Overview section to understand your current position. Then, use the detailed sections to identify what drives or limits your visibility.

Use this report as a competitive intelligence tool rather than a simple analytics dashboard. The insights show where competitors are winning and how your brand compares in each area. Regularly monitoring these trends helps you act before the gap widens. If your visibility is strong in Southeast Asia but weak in North America, investigate whether that’s intentional or a missed opportunity. If your content ranks well in some topics but not in others, focus on those missing categories to improve overall coverage.

The recommendation landscape changes quickly as AI models update their data and logic. What performs well today might shift in a few months. Checking your brand report regularly helps you notice early changes, like competitors gaining ground or new regions showing unexpected growth. Brands that succeed in this new environment are the ones that understand their data, respond to it, and keep improving based on what the report reveals.

Frequently Asked Questions

How often is the brand report updated?

Data is collected continuously across six AI platforms. Each report reflects near real-time monitoring, with the timestamp (e.g., updated 9/10/2025) marking the most recent data compilation.

Why do some AI models exceed 100% visibility?

Percentages above 100% indicate multiple mentions per response. For example, 202% on Grok means the model referenced your brand twice on average in relevant answers.

How do brand visibility and share of voice differ?

Visibility measures how often your brand appears in AI outputs. Share of voice measures your proportion of total mentions. The first reflects presence; the second, dominance.

What are “Non-Branded” topics?

These are user questions without brand names where AI models recommend options. Strong performance here shows your brand’s discoverability in organic, unbiased contexts.

Why is citation share lower than visibility?

High visibility but low citation share suggests awareness without authority. Strengthen content accuracy, depth, and external validation to improve trust signals.

How should I prioritize AI platforms for improvement?

Concentrate on where your audience is most active. If ChatGPT and Perplexity drive most queries, focus optimization there before expanding to lower-performing models.

Can I view the actual user questions?

Yes. The Prompts section lists real queries that triggered AI responses in your category. Analyzing these reveals intent patterns and content opportunities.

What if competitors outrank my brand?

Examine which topics or prompts they dominate. Identify missing depth or citation quality in your own materials, then close the gap through focused content enhancement.

Download Mention Network Extension