The Role of AI Search Monitoring in Competitive Analysis

As ChatGPT processes over 400 million weekly queries and Google's AI Overviews appear on billions of searches monthly, brands that fail to track their presence in these responses are essentially invisible to a growing segment of their audience. AI search monitoring has evolved from a futuristic concept into an operational necessity for competitive analysis in 2025.

- AI search monitoring tracks brand mentions and citations across generative platforms like ChatGPT, Perplexity, Google AI Overviews, and Gemini

- Share of AI Voice measures your competitive position by calculating what percentage of citations you capture versus rivals

- Traditional SEO metrics like click-through rates are being replaced by impression scores and citation frequency in AI responses

- Continuous monitoring surfaces competitive moves in real time, revealing pricing changes, feature launches, and messaging shifts before they impact market share

- Domain-specific optimization strategies are essential, as methods effective for historical content differ dramatically from tactics that work in technical or legal domains

Why Traditional Competitive Analysis Falls Short in the AI Search Era

Traditional competitive analysis relies on metrics designed for a world where users click through to websites. The fundamental assumption behind tracking SERP rankings and monitoring backlink profiles is that visibility drives traffic, and traffic drives conversions. That assumption no longer holds universally.

The information landscape has fundamentally shifted. While businesses once tracked SERP rankings and backlinks, today's winners monitor something far more consequential: their visibility in AI-generated answers. With ChatGPT processing hundreds of millions of weekly queries and Google's AI Overviews appearing on billions of searches monthly, brands that fail to track their presence in these responses are essentially invisible to a growing segment of their audience.

- The Flaw in Traditional Metrics: Traditional analysis relies on the assumption that visibility drives traffic. However, over 58% of Google searches now end without a click because AI delivers instant, synthesized results directly on the SERP. The traditional funnel has collapsed.

- The Competitive Intelligence Gap: You might dominate traditional search rankings while losing mindshare in AI-generated responses. Your competitor could appear in every key ChatGPT answer, yet remain invisible in Google's top 10. Without AI search monitoring, you are operating with incomplete competitive intelligence.

Why it matters: The brands that master AI search monitoring gain early warning systems for competitive threats. When a rival's content suddenly appears in AI responses for key queries, you can investigate their strategy and respond before they capture significant market share. When negative sentiment emerges in AI mentions, you can address the root cause before it becomes pervasive.

Understanding Share of AI Voice as Your Core Competitive Metric

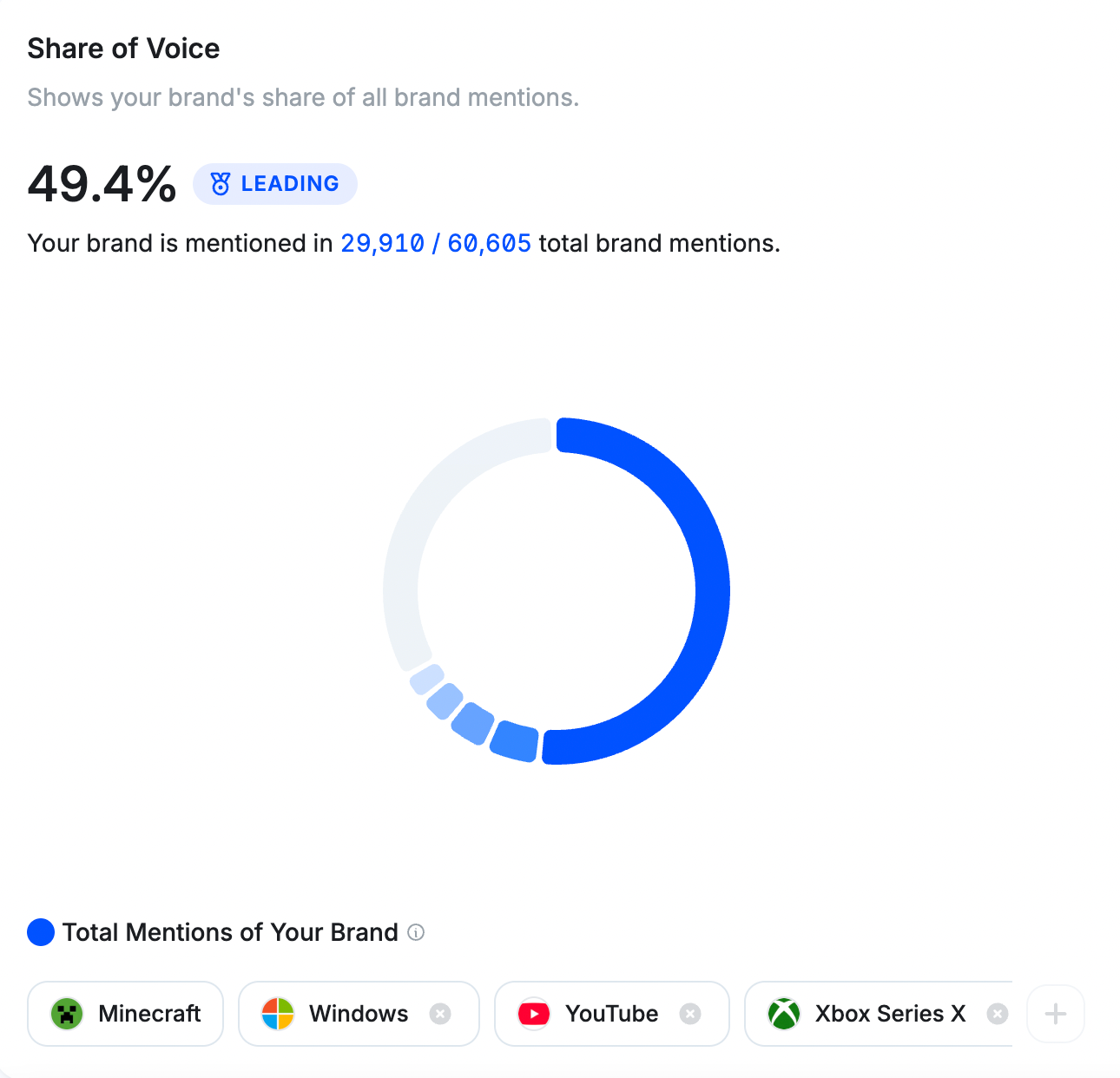

Share of AI Voice represents the percentage of citations your brand captures versus competitors across AI-generated responses. This metric parallels share of voice in traditional advertising but applies to the conversational queries users ask AI engines.

The calculation works by defining a prompt library of questions prospects actually ask, from "What is the most popular game right now?" to ". Mention Network automatically runs these across multiple AI engines, identifying which brands get cited, how often, and in what context. If your brand appears in 30 out of 100 relevant AI responses while your main competitor appears in 45, they're winning 15% more Share of AI Voice in that category.

This metric matters because it directly correlates with brand consideration in purchase/use decisions. When users ask AI engines for recommendations, the brands mentioned shape the consideration set. High Share of AI Voice means your brand consistently enters these conversations, while low share suggests prospects never encounter you during their research phase.

Tracking Share of AI Voice reveals competitive positioning shifts before they appear in traditional metrics. A competitor launching aggressive content marketing might not immediately impact your SERP rankings, but their rising Share of AI Voice signals an emerging threat. Conversely, declining competitor citations suggest vulnerabilities you can exploit by filling content gaps they're neglecting.

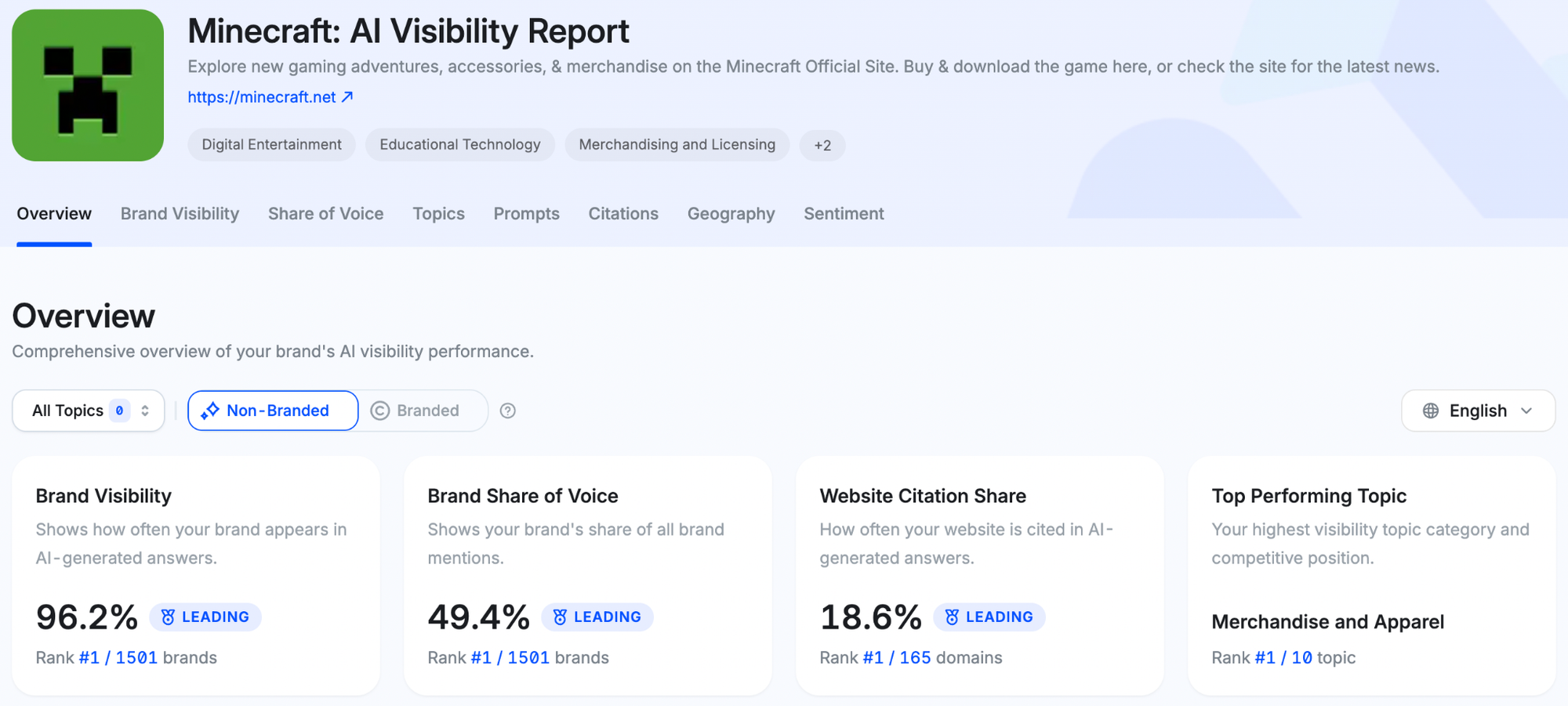

Read Minecraft's Report Overview

Real-Time Competitive Intelligence Through Continuous AI Monitoring

Most AI search monitoring tools today rely on large language models (LLMs) that use datasets delayed by several months and in some free versions, up to one full year behind real-world information. When user queries are answered using outdated training data, businesses cannot rely on these tools for timely market insights, trending topics, or user behavior shifts. As a result, decision-making becomes slower and less informed.

Unlike conventional tools, Mention Network operates based on real-time data generated directly from user prompts across AI chatboxes.For example, when someone asks:

"What is the most popular game right now?"

AI chatboxes respond using live information, similar to performing a real-time Google AI search and others LLMs. Mention Network captures these real-time queries and responses to create accurate reports that reflect what users are actively searching and asking today, not months ago.

Continuous monitoring also reveals patterns invisible in point-in-time analysis. Seasonal fluctuations in competitor activity, cyclical pricing adjustments, and gradual messaging evolution only become apparent when tracking data over time. These patterns inform predictive intelligence, helping businesses anticipate competitor behavior based on historical patterns.

Real-time prompt data provides:

- Immediate trend detection

- More accurate AI search visibility

- Better market intelligence for brands

- Stronger competitive insights

Why it matters: As AI becomes the default search interface, tools that rely on outdated LLM datasets will increasingly fall behind. Platforms like Mention Network built on real-time prompt signals represent the next phase of AI-powered search analytics.

Integrating AI Search Monitoring Into Your Competitive Strategy

Implementation requires more than subscribing to monitoring tools. Effective AI search monitoring integrates into existing workflows, informs cross-functional decisions, and evolves as AI platforms change.

AI search monitoring must be embedded into existing workflows to generate insights, not just data.

- Define Your Prompt Library: Focus on conversational queries spanning the customer journey (Awareness, Consideration, Decision), ensuring the library is comprehensive yet actionable.

- Select the Right Platform: Choose a solution that balances coverage (monitoring multiple AI engines like ChatGPT, Gemini, Perplexity, Copilot) with accuracy and seamless integration.

- Operational Integration: Use tools like Slack, Teams, or Salesforce integration to ensure competitive insights reach decision-makers in their natural workflow, rather than languishing in separate dashboards.

- Establish Response Protocols: Document the action plan for critical events. Who owns the response when a competitor gains SoAIV? Who addresses negative sentiment? This ensures a coordinated, proactive approach.

The optimization loop closes the strategy cycle. Regular analysis of which content types, formats, and optimization techniques improve your AI visibility creates institutional knowledge that compounds over time. Teams should review monitoring data monthly to identify patterns, test hypotheses about what drives citations, and refine their generative engine optimization (GEO) tactics based on evidence rather than assumptions.

The Future of AI Search and Competitive Intelligence

The competitive intelligence landscape will continue fragmenting as search behavior diversifies. Users already discover information across traditional search engines, AI chat interfaces, voice assistants, and social platforms. This fragmentation means brands must maintain visibility across multiple surfaces rather than optimizing for a single dominant channel.

- From Reactive to Predictive: Future monitoring systems will analyze historical data to forecast competitor behavior, alerting teams to likely strategic moves before they occur. This transforms monitoring into a proactive strategic advantage.

- Evolving Metrics: Measurement will move beyond simple citation counts. New metrics will track the quality of context around mentions, position within the AI response, and the alignment between brand messaging and AI-generated descriptions.

- SEO and GEO Convergence: GEO will not replace SEO; it is complementary. Since approximately 50% of sources cited in AI Overviews also rank in the top 10 results, strong SEO fundamentals remain crucial. The most effective strategies optimize for both traditional visibility and AI citation frequency simultaneously.

The democratization of AI search monitoring will level competitive intelligence playing fields. Early-stage startups and solo founders will access the same visibility data as enterprise competitors, eliminating the information asymmetry that traditionally favored large incumbents with dedicated competitive intelligence teams. This democratization will accelerate market dynamics as all players can detect and respond to competitive moves with similar speed and accuracy.

Conclusion

AI search monitoring is not a new tool, it is a fundamental shift in how brands compete for attention in an AI-mediated discovery environment. The question is no longer whether your brand ranks in traditional search results, but whether it appears in the AI-generated answers shaping prospect decisions.

The winners will be the brands that treat AI visibility as a core competitive priority, tracking Share of AI Voice with the same rigor they once applied to SERP positions. They will leverage continuous monitoring to anticipate and counter competitive moves before they impact market share.

The infrastructure for AI search monitoring is mature and available today. The strategic commitment to use it is what separates the market leaders from the followers.

FAQ

What is AI search monitoring?

AI search monitoring tracks when and how your brand appears in AI-generated responses across platforms like ChatGPT, Perplexity, Google AI Overviews.

How is Share of AI Voice calculated?

Share of AI Voice measures the percentage of relevant AI-generated responses that mention your brand versus competitors, calculated by running target queries across multiple AI platforms and tracking which brands appear in the results.

Do I still need traditional SEO if I'm doing AI search monitoring?

Yes. Strong SEO fundamentals increase the likelihood of appearing in AI results, as about 50% of AI-cited sources also rank in traditional top 10 results.

Which AI platforms should I monitor?

At minimum, monitor Google AI Overviews, ChatGPT, and Perplexity, as they represent the largest user bases.

How often should I review AI search monitoring data?

Review high-level metrics weekly to catch significant competitive shifts, conduct detailed analysis monthly to identify patterns and optimization opportunities, and set up alerts for immediate notification of critical changes in Share of AI Voice or competitor activity.